Blockchain is a decentralized and immutable ledger system. It provides banks with an opportunity to reduce the cost of transactions, enhance security, ease compliance, and settle transactions within a very short period.

Major financial institutions, such as JPMorgan Chase and Goldman Sachs, are actively developing blockchain-based applications, particularly in cross-border payments, trade finance, and Know Your Customer (KYC) procedures.

In this blog piece, we will take a close look at what blockchain is and its role in the banking sector. Are you ready to broaden your knowledge about blockchain in banking?

Blockchain

Blockchain is a type of digital ledger where transactions are stored across a network of decentralized computers. In contrast to regular databases, the information on the blockchain cannot be modified or deleted after confirmation, which makes the system extremely safe and transparent. Its design renders records tamper-proof and reliable.

Role of Blockchain in the Banking Industry

Proponents of blockchain claim that it offers many important advantages to banking:

Boosted Efficiency

Blockchain can automate fundamental processes, including verifying transactions and compliance management, reducing manual labor and inaccuracies

This not only saves time but also assists banks in settling transactions faster and at a lower cost.

Protection against Fraud

Due to its immutable nature, blockchain checks the integrity of transactions, and it is highly difficult to manipulate data by fraudsters. This level of security enhances security in such aspects as payments, lending, and ID verification.

Reduced Operating Expenses

Blockchain reduces costs in such spheres as cross-border transfers, trade finance, and settlements by eliminating middlemen. Such savings can even translate to cheaper service charges for the customers.

With smart contracts, code-driven agreements that run automatically, banks can offer fresh services like programmable loans and customized financial products.

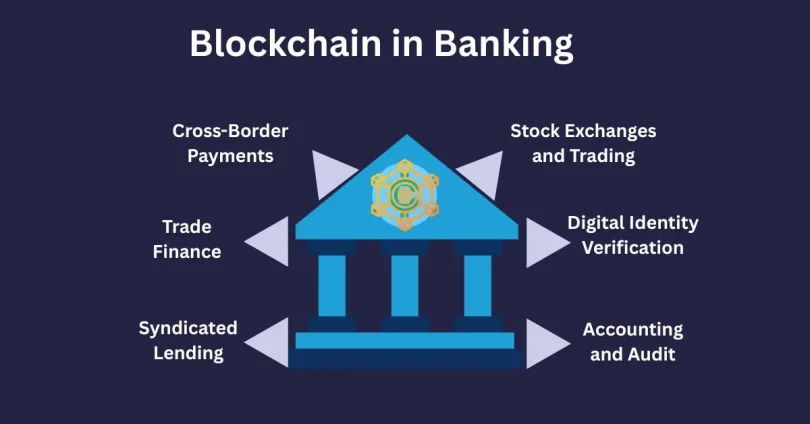

Use Cases of Blockchain Technology in Banking 2025

1. Cross-Border Payments

One of the fundamental activities in finance is payments and blockchain is making them more efficient around the world.

Banks are looking at blockchain to make domestic and cross-border transfers quicker and cheaper, and in many cases, without the involvement of third-party processors such as SWIFT.

The cost of cross-border payments is reduced (2-3 percent fee) and the time of payment is shortened without third-party delays.

Transfers using crypto can be risky, including exchange volatility, hacking and no recourse in case of provider failure.

2. Stock Exchanges and Trading

In conventional stock transactions, there are several intermediaries. Blockchain cuts out most of the middle steps, making settlements faster and way more transparent.

Eliminates middle-men, accelerates trades, and minimizes unnecessary procedures.

Management of the private keys is of high importance; loss or theft may result in loss of assets. There is additional security with multi-signature options.

3. Trade Finance

Blockchain simplifies trade finance by digitizing and automating traditional paperwork like shipping documents, invoices, and credit letters. It makes it transparent and faster to verify between trade partners across the world.

Removes duplication of documentation, enhances accuracy and allows sharing of data in real-time across stakeholders.

The use of platforms can be restricted by law (e.g., sanctions); non-blockchain users cannot access blockchain-based documents.

4. Digital Identity Verification

Blockchain provides users with the ability to register their identity once and use it repeatedly in services, which makes it more private, controlled, and faster.

Minimizes redundant identity checks; users have the choice of what to share and with whom.

There are still privacy issues, whereby once the data is on-chain, it is accessible to the network participants unless it is encrypted or restricted.

5. Syndicated Lending

A loan given by several banks may take several weeks. Blockchain simplifies the procedure by allowing collective compliance verification and open task assignment.

Saves time, expense, and redundancy of compliance procedures such as KYC and AML throughout the loan organization.

It is complicated to implement in a variety of banks; all the participants should use compatible blockchain solutions.

6. Accounting and Audit

Accounting systems become modernized with blockchain’s tamper-proof, real-time ledgers.

It supports transparent reporting and can automate parts of auditing and invoicing.

Provides data integrity using cryptographic hashes; eases auditing and reduces compliance expenses.

7. Credit Reporting

It enables people and companies to control and exchange their credit records without involving third parties.

Increases transparency and reduces the cost of verification and returns data control to users.

The immutability of blockchain may conflict with such laws as GDPR or FCRA that presupposes the right to be forgotten.

8. Hedge Funds

The number of crypto hedge funds is increasing, and blockchain allows creating decentralized analogs where investors and strategists can openly take part.

Makes investment more democratic, more transparent, and facilitates greater access to crypto-based strategies.

Individual investors are still worried about volatility and lending risks in crypto markets.

9. Crowdfunding (ICOs)

Initial Coin Offerings (ICOs) have been facilitated by blockchain, where startups can raise funds worldwide with tokens rather than equity. It provides international access, rapid liquidity, and decentralized fundraising.

The absence of regulation makes it more likely that scams will occur and investors will lose their money; several governments are developing legal frameworks for this.

10. Peer-to-Peer (P2P) Transfers

P2P apps built on blockchain remove the boundaries, and it is possible to transfer money instantly to any user across the globe. Enable direct transactions in real-time with low or no fees.

The conversion of currency may result in loss of value; the introduction of fiat will make transactions slow.

Conclusion

Banks still experimenting with the transformative capabilities of blockchain, including cost cutting and accelerating transactions, improving security and compliance, the path to large-scale adoption is a slow one. The banking industry is prudently pursuing a hybrid approach with obstacles such as scalability, integration, and high energy requirements, as well as the changing regulations, still in place. As long as financial institutions and stakeholders are willing to take the next step, they should be prepared to actively engage in blockchain pilots, and join the appropriate consortia, and collaborate with regulators to develop interoperable, sustainable models. When developing strategy in your bank or fintech, this is the time to invest, make a small step, think strategically, and move towards the future with blockchain.

FAQs – Blockchain and Banking

Major barriers include scalability limitations, high energy usage, compatibility issues with legacy systems, and unclear regulatory standards.

Traditional international transfers can take days. With blockchain, processing times have dropped to minutes or even seconds, while fees decrease.

Yes, it’s a cryptographic, tamper-resistant ledger that ensures transaction integrity. Once recorded, data can’t be altered, significantly lowering risks in payments, lending, and identity verification.

Banks deploy blockchain for trade finance (digital bills of lading and letters of credit), digital identity verification, real-time auditing and accounting, credit reporting, and decentralized lending.

They can. Public blockchains’ open records may clash with privacy laws like GDPR or FCRA, which require data deletion and confidentiality. Ensuring compliance through encryption or permissioned ledgers is critical.