Blockchain is transforming the real estate sector, whether it is the tokenization of ownership or simplification of transactions and increased transparency. This guide takes a deep dive into the uses of blockchain in real estate, the way blockchain is transforming real estate, why it is important, and where it is going.

The Importance of Blockchain in Real Estate

Real estate is the biggest asset in the world, but the industry remains bogged down in paperwork, sluggish deals and outdated procedures.

Blockchain has offers real estate sector:

- Errors and fraud disputes are minimized by immutable, transparent records.

- Smart contracts automate the payment of rent, escrow, and renewal of the lease

- Tokenization allows fractional ownership of property.

- International availability allows investing across borders without any difficulties

- Funds and property portfolios accounting and real-time data

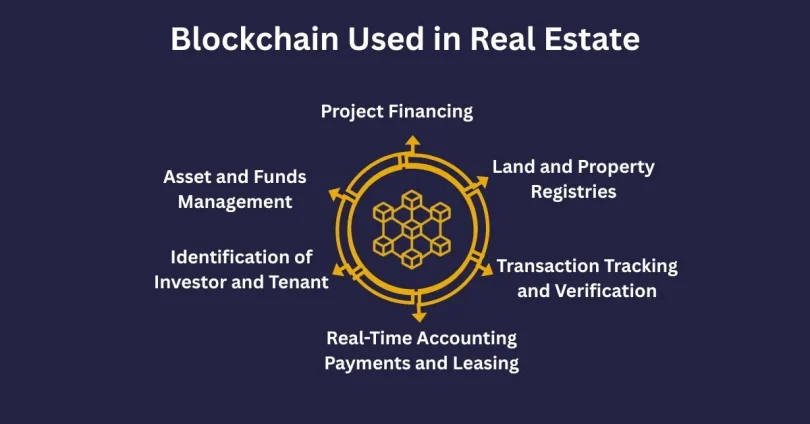

Blockchain in the Real Estate Sector

These are some of the main ways through which blockchain technology is changing the real estate sector:

1. Asset and Funds Management

Real estate assets are complicated when the investors possess a large portfolio or when the ownership is shared among several stakeholders. It is necessary to keep proper records of assets and financial flows.

Blockchain is used as a transparent, real-time and tamper-proof ledger to trace these transactions. It is immutable, and thus no party can modify the records at will.

Also, the same system can be used to include digital currencies in the process of leasing or purchasing properties. Automation of utility payments using smart contracts can also be done using these tokens.

Smart contracts also make the management of leases and rent collection more efficient. Decision-making is more certain and quicker with real-time data at hand.

2. Project Financing

Development of real estate usually involves the funding of more than one party. Managing these contributors may be a problem.

Blockchain enables easy tracking, securing, and automating financing via a common ledger. Contributors can be involved in the governance of the project through smart contracts, particularly through organizations such as Decentralized Autonomous Organizations (DAOs), which guarantee transparency and accountability in the process.

3. Land and Property Registries

Property rights are one of the fundamental principles, and the security of the land registry is the first step towards the protection of property rights.

In case of outdated or weak registry systems, ownership records can be manipulated, which is a significant threat to property investors.

Cryptography and decentralization enable blockchain-based registries to make unauthorized changes very hard. The property titles may be issued as non-fungible tokens (NFTs), providing a secure, verifiable, and digital record of ownership.

4. Identification of Investor and Tenant

Identity verification is essential in real estate. Buyers and tenants should be assured that they are dealing with genuine owners and landlords should verify the identity of tenants.

Whereas the traditional systems are based on centralized databases, blockchain provides a more secure and manipulation-resistant option. On-chain identity records are more reliable and difficult to forge/copy, which increases trust in transactions.

5. Transaction Tracking and Verification

Conventional real estate deals are characterized by numerous unintegrated systems and a lot of paperwork, which makes due diligence time-consuming and expensive.

Blockchain makes this easier by providing a single and transparent record system. Owners can demonstrate ownership of property with only a private key. Potential buyers or tenants are able to confirm the entire transaction history, including liens, directly out of the ledger.

6. Real-Time Accounting Payments and Leasing

Real estate payments are normally subject to many intermediaries and delays that may increase the cost.

Blockchain addresses this by facilitating near-instant payments using digital tokens and smart contracts automatically execute transactions. Title transfer and payment may be simultaneous in a sale of property.

Leases may also be managed using programmable smart contracts, which specify payment terms and automate each payment. Every transaction gets logged on a tamper-proof ledger.

Major Use Cases in Real Estate

Here’s how blockchain-driven innovations are actively being used or piloted in real estate:

|

Use Case |

What It Does |

Key Benefits |

|

Tokenization |

Turns property into tradable digital tokens |

Fractional ownership, accessibility, and liquidity |

|

Title & Registry Management |

Records ownership and liens on a decentralized ledger |

Immutable records, fewer disputes |

|

Smart Contracts |

Automates triggers (leases, payments, escrows) |

Efficiency, reduced admin costs |

|

Project Financing |

Raises capital via tokenized stakes and crowdfunding |

Broader investor pool, faster funding |

|

Investor/Tenant Identity |

Enables secure KYC/AML with decentralized IDs |

Fraud reduction, compliance |

|

Real-Time Accounting |

Shares live financial and transaction data |

Transparency, accurate reporting |

Benefits of Using Blockchain in Real Estate

Smooth Transactions

- Blockchain makes real estate easy by eliminating middlemen.

- Smart contracts allow buyers and sellers to meet, negotiate, and seal deals directly, without the involvement of MLS platforms or paper-based systems that are slow.

- Buyers and sellers can deal directly, cut out the banks and save both time and money.

Increased Data Transparency and Access

The real estate transactions are usually multilateral involving owners, tenants, lenders, investors, and managers.

Blockchain provides reliable data to all people in real-time.

Stakeholders can review transactions, monitor occupancy, and evaluate costs with confidence using immutable, decentralized records to make data-driven decisions.

Facilitating Fractional Ownership

Using tokenization, it is possible to divide property into digital shares.

Several owners may invest and get returns according to their share, which is all monitored and managed with the help of smart contracts on the blockchain.

Commercial Property Investment

Provides an opportunity to small investors to invest in large-scale projects by buying fractional tokens. This makes the real estate more inclusive and increases market participation.

Tokenized Assets Expand to Larger Markets

Real estate projects can be tokenized so that individual properties can be divided into digital units. These shares are a form of ownership in the books but the physical asset is still there, this makes property more liquid and accessible.

Future of Blockchain in Real Estate

Although adoption is yet to reach its peak, blockchain is likely to increase the speed of transactions and transparency in the market.

Deals that used to take weeks to complete could be done in minutes with smart contracts automating the process of identity verification, lease management, and title transfer.

The Reason Why Agents are Adopting Blockchain?

It enables peer-to-peer transactions, real estate agents are not marginalized, but they are in a position to develop the safest smart contracts and minimize their overheads. The technology provides the agents with the means to work smart rather than hard.

Challenges and Considerations

Blockchain has its potential, but it does not come without challenges:

- Regulatory uncertainty: Laws and regulations vary greatly from one country to another, creating major inconsistencies.

- Interoperability problems: Various blockchains have to be interconnected.

- Smart contract risk Bugs may cause transactions to fail or may be exploited

- Privacy issues: There is a risk of revealing sensitive information in the public entries.

- Governments and institutions are slow to adopt.

It can eliminate friction, liberalize markets and democratize property investment. However, the pace at which it is adopted across the US, Europe, and the rest of the world will be determined by key upgrades in regulation, technology, and interoperability.

Final Words

Blockchain is no longer a buzzword, but it is the foundation of a more intelligent, faster, and transparent real estate sector. Whether it is automation of rent payments using smart contracts or verification of property ownership by use of tamper-proof records, blockchain is slicing through the old ways of doing things and opening up a new world of a global, accessible, and trustworthy real estate ecosystem.

With increased adoption, the most benefited are the forward-thinking professionals, including developers, investors, and so on. It is time to be ahead of the game.

Wondering how blockchain might future-proof your real estate business? Begin to experiment with platforms, tools, and pilot projects today and join the next generation of property innovation.

FAQs

Blockchain logs every transaction with a secure timestamp, making records unchangeable and enhancing trust while cutting down on fraud. Each action is logged and viewable in real time.

Tokenized real estate breaks property ownership into digital tokens on a blockchain, allowing fractional investment and increased liquidity for smaller investors.

Yes, blockchain-based registries can securely store property titles, using cryptographic verification and decentralization to prevent tampering and streamline verification.

Key obstacles include legal and regulatory uncertainty, system interoperability, smart contract bugs, privacy concerns, and resistance from legacy institutions.