Blockchain technology.

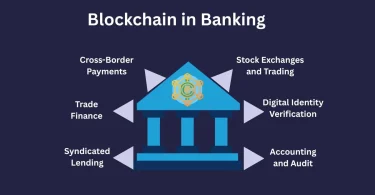

Blockchain technology has the huge potential of transforming financial services and banking transactions. It is a type of ledger system that operates in a decentralized manner, allowing for transactions to take place securely and transparently, without the involvement of a middleman. In simple terms, blockchain technology allows securing transfer of value or information from one party to another without the need for a middleman.

Blockchain technology and its transformative impact on the financial services and banking industry.

The banking industry and financial services has been one of the first industries to adopt blockchain technology. This is because blockchain technology offers multiple benefits to this industry Firstly, it enables faster transactions. Secondly, blockchain technology can reduce the risk of fraud. Thirdly, blockchain technology is highly secure and resistant to tampering and hacking. Fourthly, by eliminating the middleman, blockchain technology can reduce costs. These benefits make blockchain technology a highly attractive option for the financial services and banking industry, leading to its quick adoption in this sector.

How blockchain technology is revolutionizing the way we transact

Faster and boosting transaction.

The most significant benefit of blockchain technology is its faster transactions. Transactions are processed in real time, which means no need to wait for lengthy and tiring processing times. It is particularly useful in the financial services industry, where time is money.

Transparent, secure and clean record.

Blockchain techs create a permanent and transparent record of all transactions and make it difficult for fraudulent activities to go undetected. The blockchain ledger system is also resistant to tampering and hacking, which makes it more secure than all other traditional systems; also reduces the risk of fraud.

Enhancing efficiency and reducing cost of financial sector.

By eliminating the need for intermediaries, transactions are processed and forwarded more quickly at a lower cost. Helpful for businesses that need to process a large volume of transactions on a regular basis.

Improved security system of banking operations.

It enables the creation of smart contracts, which are self executing contracts that are capable of automatically triggering actions when certain conditions are met. All businesses need that their transactions are secure and their data protected, blockchain techs help in fulfilling their risk and security concerned requirements

Increases financial inclusion.

Finally, blockchain technology increases financial inclusion by providing financial services to people who are currently not served through traditional banking systems. The blockchain technology is used to create a decentralized financial system that does not rely on intermediaries. Through digital wallets of blockchain technology customers can perform all the banking tasks without having a bank account even without reaching the banks or financial organizations.

Conclusion.

In a nutshell, blockchain technology has the potential to transform the financial services and banking industry in significant ways, by improving security, reducing costs, increasing efficiency and providing access to financial services for more people. As blockchain technology continues to evolve, we can anticipate seeing even more innovative uses for this technology in the financial services and banking industry.

Leave a Comment