Overview

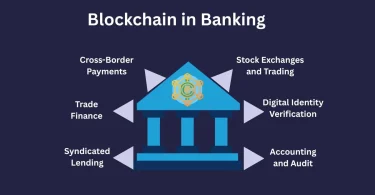

AI has solely damaged the surface of the insurance industry. There are dozens of methods that would be greatly improved mistreatment AI, with the potential for a lot of insurance suppliers to implement the technology across their businesses over time. a number of the applications which will profit most from AI embody pricing, claims handling and fraud notice ion. These new technologies are already being applied within the insurance industry. Some insurance firms are using AI and machine learning to modify bound components of the claims handling process and improve client service. Block chain is being employed to secure transactions, detect insurance fraud, forestall risk and even probably decrease the value of a policy.

As these technologies become a lot of widespread, the insurance trade may potentially become more efficient, correct and secure. As AI and different digital solutions still be implemented, there are many advantages which will be knowledgeable about by insurance firms from motorcar insurers, to householders and life and customers alike. Moreover, insurers are sitting on a treasure-trove of massive knowledge, the most ingredient AI needs to be successful. The abundance unstructured data may be leveraged through AI to extend client engagement, produce a lot of customized service and more significant promoting messages, sell the proper product to customers and target the right customer. That said, we tend to are beginning to see a world push by insurance firms to reinforce their technological capabilities in order that they’ll do business faster, cheaper and a lot of securely.

How insurers will use and manage the artificial intelligence

There are some points which declared insurance accelerations by using artificial intelligence

- Specialize in data. aggregation the proper data, improvement it up and standardizing it, and creating it out there are essential to chop and chop and dependably deploying AI.

- Modify capabilities and Bring AI and analytics and automation along to assist apportion resources, standardize and utilize data and improve governance and scale solutions.

- Suppose long term. once you begin currently on developing key capabilities and appreciate AI up skilling and you will doubtless see edges for years to come.

- Create AI accountable AI. to cut back AIs risks and create it explainable, apply the accountable AI toolkit.

External factors of IA

AI is not simply creating waves within the insurance industry and it is however and it’s additionally impacting external factors that would have an effect on however insurance companies operate. AI is adept at noticing behaviors and trends, and firms are getting to be able to profit of that data. the strongest samples of this can be AI and self driving vehicles. Autonomous automotive are designed with safety in mind and such a big amount of folks might assume there will be fewer traffic accidents once most cars on the road drive themselves. however and in a world with nearly no car accidents and there might not be abundant use for automotive vehicle insurance policies. during this situation and insurance corporations may have to measure how they worth their policies and what’s enclosed in their policies and if they will sustain their business through alternative sorts of insurance and like business or life insurance.

Leave a Comment