Overview

When you use machine learning, you furthermore may get a wonderful grasp of however trade costs evolve over the course of a year. And this ends up in a final, a lot of refined benefit. Suppose you notice that a provider usually will increase their prices in October. you’ll be able to create a note to top off on bound merchandise in September, avoiding the forthcoming increase, saving you money, and boosting your overall profit margin.

Features

Price prognostication may be a helpful feature for customers furthermore as businesses. A price prediction tool motivates users to have interaction with a whole or value offers so as to pay their cash wisely. value prediction permits businesses to line evaluation during a manner that builds client engagement and loyalty. With Machine Learning technology a price prediction drawback is developed as a multivariate analysis that is a applied math technique wont to estimate the connection between a dependent target variable and single or multiple freelance variables. In regression, the target variable is numeric. this text can specialize in mil algorithms used for value prediction in 3 totally different industries.

What is price casting and how machine learning healp in price casting in detail

Price prognostication is predicting a goods product service price by evaluating numerous factors like its characteristics, demand, seasonal trends, different commodities’ costs and fuel offers from numerous suppliers, etcetera worth forecasting is also a feature of consumer-facing travel apps, equivalent to Train line or Hopper, wont to increase client loyalty associate degreed engagement. At constant time, other businesses may additionally use info concerning future prices. Entrepreneurs may have to outline an best time to shop for a commodity to regulate prices of product or services that need a commodity lumber, coffee, gold or appraise the investment charm of fastened assets. worth prediction may be developed as a regression task. multivariate analysis may be a applied mathematics technique wont to estimate the link between a dependent/target variable electricity price, flight fare, property price and single or multiple freelance interdependent variables AKA predictors that impact the target variable. multivariate analysis additionally lets researchers confirm what quantity these predictors influence a target variable. In regression, a target variable is usually numeric. In general, price prognostication is completed by the means that of descriptive and prophetical analytics.

How machine learning help in stock and price forecast

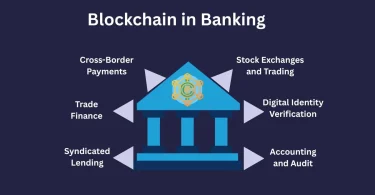

Evaluates a company’s stock by examining its intrinsic value, as well as however not restricted to tangible assets, money statements, management effectiveness, strategic initiatives, and shopper behaviors; basically all the fundamentals of a company. Being a relevant indicator for long-run investment, the elemental analysis depends on each historical and gift information to live revenues, assets, costs, liabilities, so on. typically speaking, the results from fundamental analysis don’t change with short news. Analyzes measurable data from exchange activities, appreciate stock prices, historical returns, and volume of historical trades; i.e. quantitative info that would identify mercantilism signals and capture the movement patterns of the stock market. Technical analysis focuses on historical information and current data rather like basic analysis, however it’s chiefly used for short trading purposes. thanks to its short-term nature, technical analysis results are simply influenced by news. standard technical analysis methodologies embody moving average support and resistance levels, furthermore as trend lines and channels.

Leave a Comment